Condo Insurance in and around Los Angeles

Townhome owners of Los Angeles, State Farm has you covered.

Insure your condo with State Farm today

Your Belongings Need Protection—and So Does Your Condo Unit.

As with any home, it's a good idea to make sure you have coverage for your condominium. State Farm's Condo Unitowners Insurance has great coverage options to fit your needs.

Townhome owners of Los Angeles, State Farm has you covered.

Insure your condo with State Farm today

Protect Your Home Sweet Home

You’ll get that and more with State Farm Condo Unitowners Insurance. State Farm has plenty options to keep your most personal possessions protected. You’ll get coverage options to match your specific needs. Thank goodness that you won’t have to figure that out alone. With attention to detail and remarkable customer service, Agent Carmel Stevens can walk you through every step to help build a policy that secures your condo unit and everything you’ve invested in.

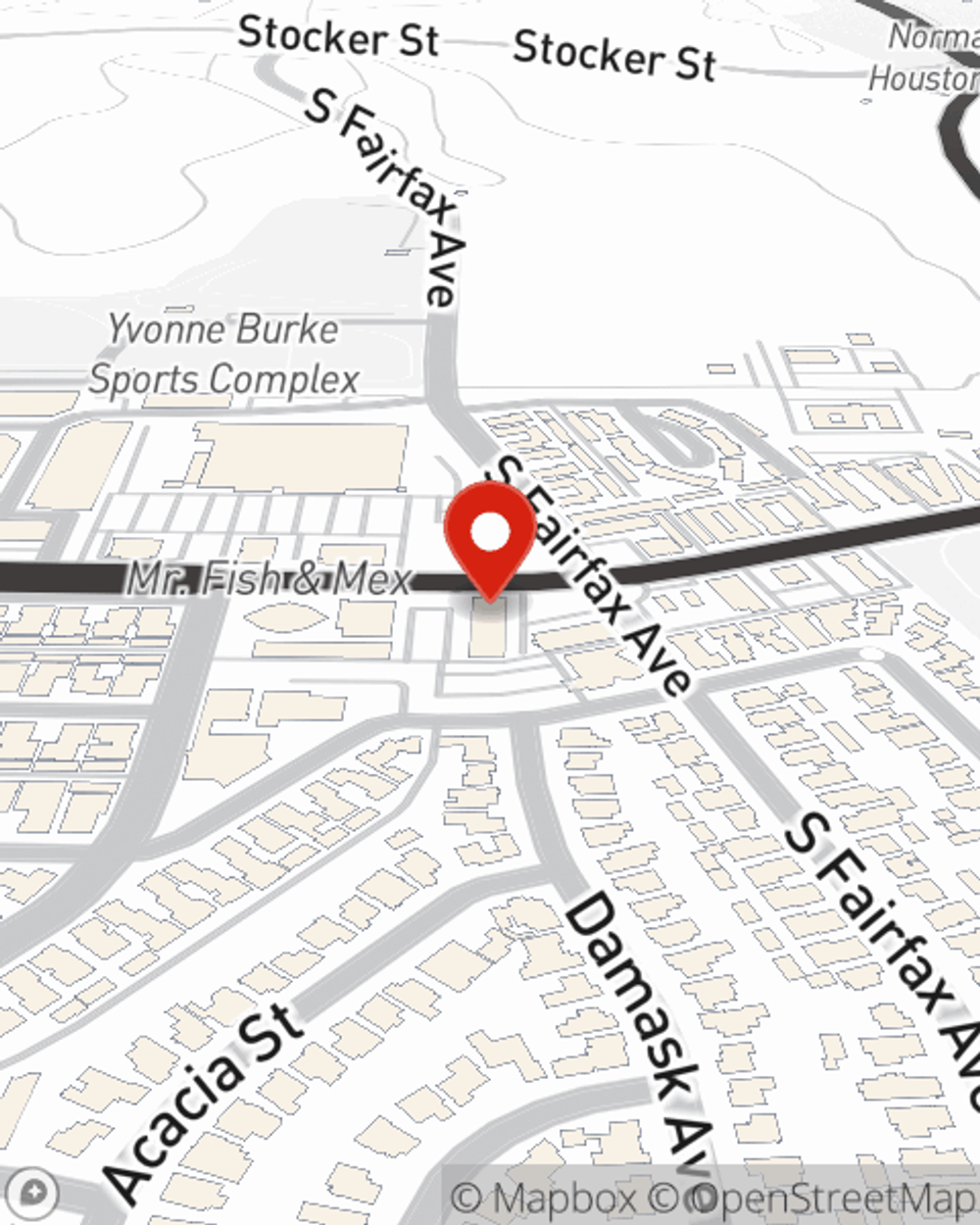

Los Angeles condo owners, are you ready to discover what a State Farm policy can do for you? Visit State Farm Agent Carmel Stevens today.

Have More Questions About Condo Unitowners Insurance?

Call Carmel at (323) 292-7930 or visit our FAQ page.

Simple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Carmel Stevens

State Farm® Insurance AgentSimple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.